What is Forex?

(Definition : How it started : History of Money : Bretton Wood)

Definition

Foreign Exchange (FX) is the exchange of one currency for another or the conversion of one currency into another currency. It refers to the global market where currencies are traded virtually around the clock.

For ex: transaction between two parties based in two different countries are done in the currency of host countries, which in this case are different. The exchange of value between the two different currencies is known as Foreign Exchange.

How it all started

In ancient times transaction between two individuals were done with the exchange of goods which both the individuals agree to. Known as the barter system.

Then around 2600BC it is believed that the Egyptians discovered gold, which around 1500BC was considered as the medium of exchange. This is believed to be earliest concepts of money used in trades.

The world’s first coin likely was made of an alloy of gold and silver, minted by King Alyattes in Sardis.

History of Money

Paper money was introduced to the world in the 18th Century. This paper money was backed by gold by 1875. Which in terms means the issuing organizations (central bank of the country) is bound to pay the bearer with equivalent amount of gold. Gold standard became the first standardized means of exchange.

Come 28 July 1941, World War 1 starts, which was followed by the World War 2. The countries involved in the war started spending lot of money on defence, which depleted gold, in turn skyrocketing its prices. This meant countries could no longer guarantee the bearer equivalent amount of gold.

Gold standard loses its meaning.

Bretton Woods

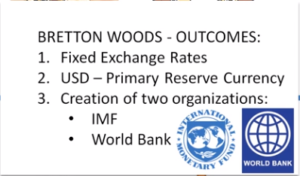

This issue was fixed in 1944, with the Bretton Woods system of monetary management. It was an agreement between all the allied countries and Japan. Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The basic idea was to substitute the gold standard with US dollars. Meaning the party countries can now pay the bearer with US dollars instead of gold.

Albert Einstein has said, “If you do the same thing over and over again, you cannot ever expect a different outcome”.

The new standard which was basically gold standard, as the US had to maintain the equivalent Gold reserve failed. With the depleting gold reserves in 1971, then US President Nixon announced that US isn’t bound to pay the party countries with gold in return to the US Dollars.

Since then the world has used a floating exchange rates for all the currency of the world.

Which is Forex.