Forex or foreign exchange or fx refers to the global market where currencies are traded globally around the clock in the 24-hour format. Unlike the stock exchange market which is only open for a portion of the day. HotForex is one of the best forex trading brokers that will set you up with all the right tools to succeed in forex trading.

PIP stands for Point In Percentage. In simpler terms, in forex trading, a PIP is considered as a ‘point’ for calculating profits and losses. Therefore when we trade currencies globally, PIP acts as a standardized unit that changes the currency quote. In the forex market, a PIP is a very small measure of the change in a currency pair. In the United States, it is usually $0.0001 U.S.dollar which is also referred to as 1/100th of 1%. In the same way, different countries have different PIP’s which helps to protect investors from huge losses. Therefore, while trading currencies, PIP acts as the fundamental unit of measure.

How to calculate the PIP value?

Let us understand the significance of a PIP value in terms of two currency pairs.

Say, if we have USD/EUR direct quote of 0.7748. What this means is that for US$1, you can buy about 0.7748 euros. Now, if there was a one pip increase in this quote (to 0.7749), the value of the U.S. dollar would relatively rise as it would allow you to buy more euros. This depends on the number of euros purchased that tells us the effect a PIP value has on the dollar amount. If an investor buys 20,000 euros with U.S.dollars, the price paid will be US$25,813.11({1/0.7748}*20,000).

Therefore if this amount experiences a one PIP increase, the price would be 25,809.78({1/0.7749}*20.000). In that case, the PIP value on a lot of 20,000 euros will be US$3.33(25,813.11-25,809.78). This demonstrates the PIP value increases completely depending upon the amount of the underlying currency (euros in this case) which is initially purchased. This is the knowledge of PIP (point of percentage) required for all the forex traders. This example shows as to how a PIP value is calculated.

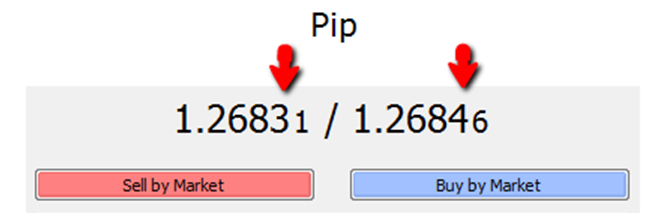

What is Pipette?

In case of a pipette, there are brokers who quote the currency pairs beyond the standard that is ‘4 and 2’ decimal places to ‘5 and 3’ decimal places. Therefore they are quoting fractional PIPS that is called as pipettes. Also, the value of a pip/pipette in dollar or euros will be different depending upon the size of the position that an investor/trader has opened. Therefore a PIP value helps us calculate our profits and losses before we start trading between two currencies.

In the forex trading system, as a forex trader, you will be dealing with huge numbers in big ways every day but that is the way it is in exchanging foreign currencies. Therefore a PIP can show you the change in your value between your currency pairs and it becomes very important to understand this. A PIP is the last decimal place of a quotation, most currencies are expressed in values out of four decimal places. This also depends on the country to country. The exception to this is the Japanese yen that it only goes out to two places.

Now that you know about PIP, how to calculate PIP and it’s significance, are you ready to start trading your currencies?

Спасибо за информацию!!!!!