Definition:

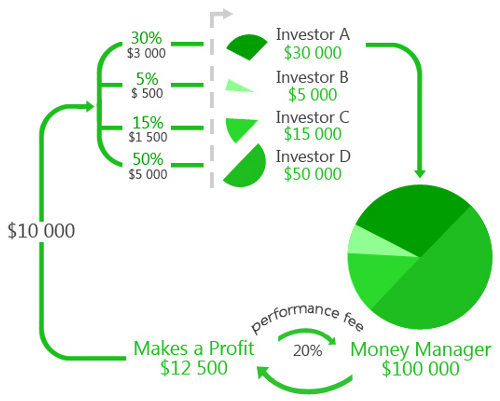

LAMM or lot allocation management module can be called the predecessor of PAMM. With LAMM account the trader not only does business with his account but his transactions get duplicated in the accounts of the investors. An investor can always check the manager’s real time action. This service benefits both trader and investor. The manager doesn’t have to worry about the number of investors that are connected to the account. Investors can independently specify the amount of funds and monitor every trade being copied. Moreover, investor can diversify funds by allocating with several managers thus reducing risks.

Advantages of LAMM Account:

- Investors fund are not transferred to managers account but stay with the investor all the time.

- It is easy to manage risk as the investor can manage the amount of funds to be allocated in LAMM account.

- One of the best features is that the investor enjoys the freedom to cancel the deal or disconnect from the managers account any time he feels like. This makes the movement of the investor very flexible and gives him his space.

- The manager can choose the desirable type of compensation, either fixed or certain percentage of the investor’s profit.

- The manager uses his personal funds for trading.

- All transactions are copied automatically.

Disadvantages of LAMM Account:

- The manager does not take any responsibility for the upshot of the trade. It is the investor himself who at his own risk approaches the manager and wants his transactions to be copied.

- There is a high minimum deposit, which means if you don’t have enough money in your account then the transactions will not get copied.

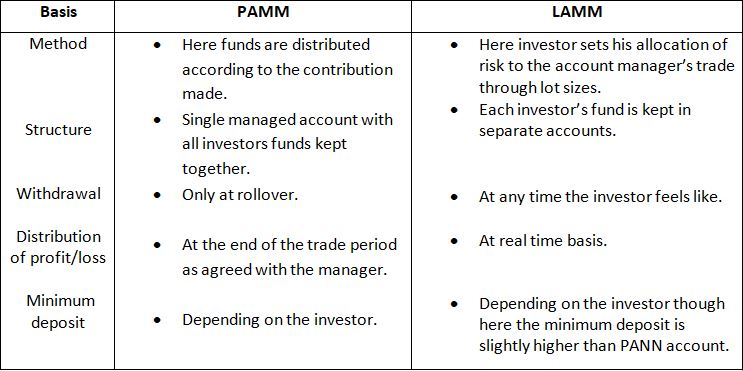

Difference between LAMM and PAMM:

To conclude, it is made clear how LAMM account works and how it is different from the PAMM account. LAMM works in a slightly different way – each time an account manager opens a position, the same position is opened in each account allocated to that strategy. LAMM is a less sophisticated version of PAMM or MAM by crudely replicating trading positions without considering underlying account size. So those who are willing to secure a secondary source of income and are keen towards becoming a forex trader contact Siby Varghese – The award Winning Forex Trader and Author at www.sibyvarghese.com. Get best possible service and advice from the very experienced ones.