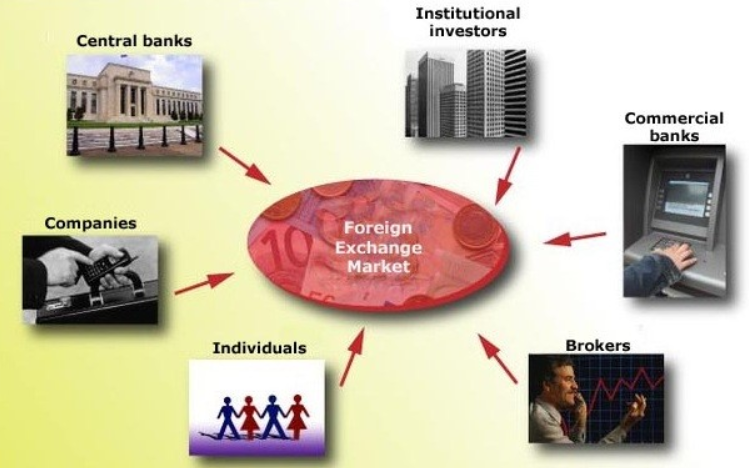

Who Trades Forex?

Any trading scenario would mean deeply understanding the market players, knowing the participants and then getting a hang on trading methods. Forex is undoubtedly one of the biggest markets by cash volume globally. It has almost $4 trillion worth of currency trading happening every single day.

Forex is not a centralized market like regulated stock markets that trade in shares of public companies. Forex is more of participants that are major institutions, which are at the top of the trading circle. The biggest and the largest forex participant get the best terms and they are capable of moving the markets with trading. The markets are really huge hence there are very meager chances of anyone manipulating the trading cycles. Now let us dig deeper into the working of Forex and which entities are involved and how they do it.

Central Banks – These are the national banks and they are ones who are in charge of issuing and lending the national currency. The central bank sets the monetary policy of interest rates and has power over increasing or decreasing the supply of the currency. They usually have huge reserves of Gold bullion; they have powers that can certainly move the market in their currency dramatically. Central banks have policy aims, which they exercise to preserve the interests of the country currency and that of the investors.

Central banks also lend and provide liquidity to larger banks serving the nations. If any banks are in trouble or any deficits then central bank is the one who is responsible for clearing the mess.

Banks – The market volume for trading is mostly traded through interbank markets. They trade for themselves as an entity and for their clients. Banks trade as a speculative venture to build their inventories of currencies. They act as a dealer to larger professional market participants. Banks make their profits by bidding that they impose on exchange rates quoted to clients.

Investment Managers and Hedge Funds – The speculative hedge funds and managers are the biggest clients for banks for trading. They exchange currencies to finance the securities they do not own and hedge against the risk in consideration to future fluctuations of the markets. This may adversely affect their portfolio. On the other hand, hedge funds are traded in very large volumes and have a lot of attention. The trading style is conservative in nature; they are big risk takers that can have a bigger influence on the forex markets.

Corporations – Bigger and smaller corporations deal with banks for trading in forex. The forex brokers are corporations that deal in forex trading they are multinational institutions. The profits earned by this organization are exposed to the risk of fluctuations in the currency exchange rates. These corporations are often at a disadvantage that forces them to have currency transactions since they are forced in the market. They do not always have the option to pick and choose while trading.

The total amount of forex traded by these corporations is dwarfed by the amount traded by managers and hedge funds. This is done to speculate in the market since many investment managers are trading as hedgers rather than speculators.

Retail Traders – Retail traders are the very bottom of a forex trading chain. For retail traders, they require forex brokers to trade for them and they do so by not hedging their risk on our trades. They usually trade through a bank for forex dealings making use of another bank.